Internal Revenue Bulletin: 2025-31

July 28, 2025

These synopses are intended only as aids to the reader in identifying the subject matter covered. They may not be relied upon as authoritative interpretations.

The Office of Professional Responsibility (OPR) announces recent disciplinary sanctions imposed on attorneys, certified public accountants, enrolled agents, enrolled actuaries, enrolled retirement plan agents, and appraisers. The OPR also announces when certain unenrolled, unlicensed tax return preparers (individuals who are not enrolled to practice before the Internal Revenue Service (IRS) and are not licensed as attorneys or certified public accountants) have been disciplined. Licensed or enrolled practitioners are subject to the regulations governing practice before the IRS, which are set out in Title 31, Code of Federal Regulations, Subtitle A, Part 10, and which are released as Treasury Department Circular No. 230. The regulations prescribe the duties and restrictions relating to such practice and prescribe the disciplinary sanctions for violating the regulations. Unenrolled/unlicensed return preparers who choose to participate in the IRS’s voluntary Annual Filing Season Program (AFSP) are subject to the guidance in Revenue Procedure 2014-42, which governs a preparer’s eligibility to represent taxpayers before the IRS in examinations of tax returns the preparer both prepared for the taxpayer and signed as the preparer. Additionally, unenrolled/unlicensed return preparers who participate in the AFSP agree to be subject to the duties and restrictions in Circular 230, including the restrictions on incompetence or disreputable conduct.

This revenue procedure provides specifications for the private printing of red-ink substitutes for the 2025 Forms W-2 and W-3. This revenue procedure will be produced as the next revision of Publication 1141. Rev. Proc. 2024-27 is superseded.

NOTE. This revenue procedure will be reproduced as the next revision of IRS Publication 1141, General Rules and Specifications for Substitute Forms W-2 and W-3.

26 CFR 601.602: Tax forms and instructions. (Also Part I, Sections 6041, 6051, 6071, 6081, 6091; 1.6041-1, 1.6041-2, 31.6051-1, 31.6051-2, 31.6071(a)-1, 31.6081(a)-1, 31.6091-1.)

Pursuant to its authority under the Congressional Review Act (CRA), Congress passed a joint resolution disapproving the final rule titled “Gross Proceeds Reporting by Brokers that Regularly Provide Services Effectuating Digital Asset Sales,” and the President signed the resolution. Under the joint resolution and by operation of the CRA, this final rule has no legal force or effect. The Department of the Treasury (Treasury Department) and the IRS hereby remove this final rule from the Code of Federal Regulations (CFR) and revert the relevant text of the CFR back to the text that was in effect immediately prior to the effective date of this final rule.

26 CFR 1.6045-1 Returns of information of brokers and barter exchanges

This notice specifies updated static mortality tables to be used for defined benefit pension plans under § 430(h)(3)(A) of the Code and section 303(h)(3)(A) of ERISA. This notice also specifies a mortality table for use in determining minimum present value under § 417(e)(3) of the Code and section 205(g)(3) of ERISA for distributions with annuity starting dates that occur during stability periods beginning in the 2026 calendar year.

Provide America’s taxpayers top-quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all.

The Internal Revenue Bulletin is the authoritative instrument of the Commissioner of Internal Revenue for announcing official rulings and procedures of the Internal Revenue Service and for publishing Treasury Decisions, Executive Orders, Tax Conventions, legislation, court decisions, and other items of general interest. It is published weekly.

It is the policy of the Service to publish in the Bulletin all substantive rulings necessary to promote a uniform application of the tax laws, including all rulings that supersede, revoke, modify, or amend any of those previously published in the Bulletin. All published rulings apply retroactively unless otherwise indicated. Procedures relating solely to matters of internal management are not published; however, statements of internal practices and procedures that affect the rights and duties of taxpayers are published.

Revenue rulings represent the conclusions of the Service on the application of the law to the pivotal facts stated in the revenue ruling. In those based on positions taken in rulings to taxpayers or technical advice to Service field offices, identifying details and information of a confidential nature are deleted to prevent unwarranted invasions of privacy and to comply with statutory requirements.

Rulings and procedures reported in the Bulletin do not have the force and effect of Treasury Department Regulations, but they may be used as precedents. Unpublished rulings will not be relied on, used, or cited as precedents by Service personnel in the disposition of other cases. In applying published rulings and procedures, the effect of subsequent legislation, regulations, court decisions, rulings, and procedures must be considered, and Service personnel and others concerned are cautioned against reaching the same conclusions in other cases unless the facts and circumstances are substantially the same.

The Bulletin is divided into four parts as follows:

Part I.—1986 Code. This part includes rulings and decisions based on provisions of the Internal Revenue Code of 1986.

Part II.—Treaties and Tax Legislation. This part is divided into two subparts as follows: Subpart A, Tax Conventions and Other Related Items, and Subpart B, Legislation and Related Committee Reports.

Part III.—Administrative, Procedural, and Miscellaneous. To the extent practicable, pertinent cross references to these subjects are contained in the other Parts and Subparts. Also included in this part are Bank Secrecy Act Administrative Rulings. Bank Secrecy Act Administrative Rulings are issued by the Department of the Treasury’s Office of the Assistant Secretary (Enforcement).

Part IV.—Items of General Interest. This part includes notices of proposed rulemakings, disbarment and suspension lists, and announcements.

The last Bulletin for each month includes a cumulative index for the matters published during the preceding months. These monthly indexes are cumulated on a semiannual basis, and are published in the last Bulletin of each semiannual period.

DEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Part 1

Gross Proceeds Reporting by Brokers that Regularly Provide Services Effectuating Digital Asset Sales

AGENCY: Internal Revenue Service (IRS), Treasury.

ACTION: Final rule; CRA Revocation.

SUMMARY: Pursuant to its authority under the Congressional Review Act (CRA), Congress passed a joint resolution disapproving the final rule titled “Gross Proceeds Reporting by Brokers that Regularly Provide Services Effectuating Digital Asset Sales,” and the President signed the resolution. Under the joint resolution and by operation of the CRA, this final rule has no legal force or effect. The Department of the Treasury (Treasury Department) and the IRS hereby remove this final rule from the Code of Federal Regulations (CFR) and revert the relevant text of the CFR back to the text that was in effect immediately prior to the effective date of this final rule.

DATES: This final rule is effective on July 11, 2025.

FOR FURTHER INFORMATION CONTACT: Roseann Cutrone or Jessica Chase of the Office of the Associate Chief Counsel (Procedure and Administration) at (202) 317-5436 (not a toll-free number).

SUPPLEMENTARY INFORMATION: The Treasury Department and the IRS published a final rule, titled “Gross Proceeds Reporting by Brokers that Regularly Provide Services Effectuating Digital Asset Sales,” in the Federal Register on December 30, 2024 (89 FR 106928) (Final Rule). The Final Rule contained amendments to the Income Tax Regulations (26 CFR part 1) under section 6045 of the Internal Revenue Code to require certain decentralized finance industry participants to file and furnish information returns as brokers. The Final Rule stated that it was effective on February 28, 2025.

On March 11, 2025, the United States House of Representatives passed a joint resolution (H.J. Res. 25) disapproving the Final Rule under the CRA, 5 U.S.C. 801 et seq. The United States Senate passed H.J. Res. 25 on March 26, 2025. The President signed the joint resolution of disapproval into law as Public Law 119-5 on April 10, 2025. Under Public Law 119-5 and by operation of the CRA, the Final Rule has no force or effect. Accordingly, the Treasury Department and the IRS hereby remove the Final Rule from the CFR.

Pursuant to the CRA, any rule that takes effect and later is made of no force or effect by enactment of a joint resolution shall be treated as though such rule had never taken effect. Accordingly, the Treasury Department and the IRS are reverting the text of the section 6045 regulations back to the text that was in effect immediately prior to the effective date of the Final Rule.

This action is not an exercise of the Treasury Department and the IRS’s rulemaking authority under the Administrative Procedure Act because the Treasury Department and the IRS are not ‘‘formulating, amending, or repealing a rule’’ under 5 U.S.C. 551(5). Rather, the Treasury Department and the IRS are effectuating a change to the CFR to reflect what congressional and presidential action already has accomplished. Accordingly, the Treasury Department and the IRS are not soliciting comments on this action, nor are they delaying the effective date.

Reporting and recordkeeping requirements.

For the reasons set forth above, and pursuant to the CRA (5 U.S.C. 801 et seq.) and Pub. L. 119-5, the Treasury Department and the IRS amend 26 CFR part 1 as follows:

Paragraph 1. The authority citation for part 1 is amended in part by reinstating the entry for §1.6045-1 to read as follows:

Authority: 26 U.S.C. 7805 * * *

* * * * *

Section 1.6045-1 also issued under 26 U.S.C. 6045.

* * * * *

Par. 2. Section 1.6045-0 is amended by:

1. Reinstating the entry for §1.6045-1(a)(21)(i);

2. Removing and reserving the entry for §1.6045-1(a)(21)(ii);

3. Reinstating the entry for §1.6045-1(a)(21)(iii);

4. Removing and reserving the entry for §1.6045-1(a)(21)(iii)(A);

5. Removing the entries for §1.6045-1(a)(21)(iii)(A)(1) and (2);

6. Reinstating the entry for §1.6045-1(a)(21)(iii)(B); and

7. Removing the entries for §1.6045-1(a)(21)(iii)(C), (a)(21)(iii)(C)(1) and (2), and (a)(21)(iii)(D).

The revisions read as follows:

* * * * *

§1.6045-1 Returns of information of brokers and barter exchanges.

(a) * * *

(21) * * *

(i) In general.

* * * * *

(iii) Facilitative service.

* * * * *

(B) Special rule involving sales of digital assets under paragraphs (a)(9)(ii)(B) through (D) of this section.

* * * * *

Par. 3. Section 1.6045-1 is amended by:

1. Reinstating paragraph (a)(21);

2. Reinstating paragraphs (b)(2)(ix) and (x);

3. Removing paragraphs (b)(2)(xi) and (b)(24) and (25); and

4. Removing the last sentence of paragraph (q).

The revisions read as follows:

(a) * * *

(21) Digital asset middleman--(i) In general. The term digital asset middleman means any person who provides a facilitative service as described in paragraph (a)(21)(iii) of this section with respect to a sale of digital assets.

(ii) [Reserved]

(iii) Facilitative service.

(A) [Reserved]

(B) Special rule involving sales of digital assets under paragraphs (a)(9)(ii)(B) through (D) of this section. A facilitative service means:

(1) The acceptance or processing of digital assets as payment for property of a type which when sold would constitute a sale under paragraph (a)(9)(i) of this section by a broker that is in the business of effecting sales of such property.

(2) Any service performed by a real estate reporting person as defined in §1.6045-4(e) with respect to a real estate transaction in which digital assets are paid by the real estate buyer in full or partial consideration for the real estate, provided the real estate reporting person has actual knowledge or ordinarily would know that digital assets were used by the real estate buyer to make payment to the real estate seller. For purposes of this paragraph (a)(21)(iii)(B)(2), a real estate reporting person is considered to have actual knowledge that digital assets were used by the real estate buyer to make payment if the terms of the real estate contract provide for payment using digital assets.

(3) The acceptance or processing of digital assets as payment for any service provided by a broker described in paragraph (a)(1) of this section determined without regard to any sales under paragraph (a)(9)(ii)(C) of this section that are effected by such broker.

(4) Any payment service performed by a processor of digital asset payments described in paragraph (a)(22) of this section, provided the processor of digital asset payments has actual knowledge or ordinarily would know the nature of the transaction and the gross proceeds therefrom.

(5) The acceptance of digital assets in return for cash, stored-value cards, or different digital assets, to the extent provided by a physical electronic terminal or kiosk.

* * * * *

(b) * * *

(2) * * *

(ix) A person solely engaged in the business of validating distributed ledger transactions, through proof-of-work, proof-of-stake, or any other similar consensus mechanism, without providing other functions or services.

(x) A person solely engaged in the business of selling hardware or licensing software, the sole function of which is to permit a person to control private keys which are used for accessing digital assets on a distributed ledger, without providing other functions or services.

* * * * *

Edward T. Killen, Acting Chief Tax Compliance Officer.

Approved: June 17, 2025.

Kenneth J. Kies, Assistant Secretary of the Treasury (Tax Policy).

(Filed by the Office of the Federal Register July 10, 2025, 8:45 a.m., and published in the issue of the Federal Register for July 11, 2025, 90 FR 30825)

This notice specifies updated static mortality tables to be used for defined benefit pension plans under § 430(h)(3)(A) of the Internal Revenue Code (Code) and section 303(h)(3)(A) of the Employee Retirement Income Security Act of 1974, Pub. L. No. 93-406, as amended (ERISA). These updated static mortality tables, which are being issued pursuant to the regulations under § 430(h)(3)(A) of the Code, apply for purposes of calculating the funding target and other items for valuation dates occurring during the 2026 calendar year.

This notice also includes a modified unisex version of the mortality tables for use in determining minimum present value under § 417(e)(3) and section 205(g)(3) of ERISA for distributions with annuity starting dates that occur during stability periods beginning in the 2026 calendar year.

Section 412 of the Code provides minimum funding requirements that generally apply for defined benefit plans. Pursuant to § 412(a)(2), § 430 sets forth the minimum funding requirements that apply to a defined benefit plan (other than a multiemployer plan described in § 414(f) or a CSEC plan described in § 414(y)). Section 430(a) defines the minimum required contribution for such a plan by reference to the plan’s funding target for the plan year. Under § 430(d)(1), a plan’s funding target for a plan year generally is the present value of all benefits accrued or earned under the plan as of the first day of that plan year.

Section 430(h)(3) provides rules regarding the mortality tables that generally are used under § 430. Under § 430(h)(3)(A), except as provided in § 430(h)(3)(C) or (D), the Secretary is to prescribe by regulation mortality tables to be used in determining any present value or making any computation under § 430.1 Those tables are to be based on the actual experience of pension plans and projected trends in that experience. In accordance with that standard, the Department of the Treasury and the Internal Revenue Service issued § 1.430(h)(3)-1 to provide base mortality tables and mortality improvement rates that apply for valuation dates occurring on or after January 1, 2024.

Section 1.430(h)(3)-1(a)(1) permits the projection of mortality improvement to be applied in either of two ways: through use of generational mortality tables or through use of static mortality tables (available only to small plans described in § 1.430(h)-1(c)(1)(ii)) that are updated annually to reflect expected improvements in mortality. Note 1 to § 1.430(h)(3)-1(c)(1)(iv) states that the static mortality tables for valuation dates occurring in calendar years starting with 2025 will be published in the Internal Revenue Bulletin.

Section 431 provides the minimum funding standards for multiemployer plans that are subject to § 412. Section 431(c)(6)(D)(iv) provides that the Secretary may by regulation prescribe mortality tables to be used in determining current liability for purposes of § 431(c)(6)(B). Section 1.431(c)(6)-1 provides that the same mortality assumptions that apply for purposes of § 430(h)(3)(A) and § 1.430(h)(3)-1(a)(2) are used to determine a multiemployer plan’s current liability for purposes of applying the full-funding rules of § 431(c)(6). For this purpose, either the generational mortality tables or the static mortality tables are permitted to be used without regard to whether the plan is a small plan.

Section 433 provides the minimum funding standards for CSEC plans. Section 433(h)(3)(B)(i) provides that the Secretary may by regulation prescribe mortality tables to be used in determining current liability for purposes of § 433(c)(7)(C). Section 1.433(h)(3)-1(a) provides that the mortality tables described in § 430(h)(3)(A) are to be used to determine current liability under § 433(c)(7)(C). For this purpose, either the generational mortality tables or the static mortality tables are permitted to be used without regard to whether the plan is a small plan.

Section 417(e)(3) generally provides that the present value of certain accelerated forms of benefit under a qualified pension plan (including single-sum distributions) must not be less than the present value of the accrued benefit using applicable interest rates and the applicable mortality table. Section 417(e)(3)(B) defines the term “applicable mortality table” as the mortality table specified for the plan year under § 430(h)(3)(A) (without regard to § 430(h)(3)(C) or (D)), modified as appropriate by the Secretary. Under § 1.417(e)-1(d)(2)(i), the applicable mortality table for a calendar year is the mortality table that is prescribed by the Commissioner in guidance published in the Internal Revenue Bulletin.

Rev. Rul. 2007-67, 2007-2 CB 1047, provides that, except as otherwise stated in future guidance, the applicable mortality table under § 417(e)(3) is a static mortality table set forth in published guidance that is developed based on a fixed blend of 50 percent of the static male combined mortality rates and 50 percent of the static female combined mortality rates used under § 1.430(h)(3)-1. Rev. Rul. 2007-67 also provides that the applicable mortality table for a calendar year applies to distributions with annuity starting dates that occur during stability periods that begin during that calendar year.

The static mortality tables that apply under § 430(h)(3)(A) for valuation dates occurring during 2026 are set forth in the appendix to this notice. The mortality rates in these tables have been developed using the methodology set forth in § 1.430(h)(3)-1(c), the base mortality rates set forth in § 1.430(h)(3)-1(d), and the mortality improvement rates that are incorporated by reference under § 1.430(h)(3)-1(b)(1)(iv)(A).

The static mortality table that applies under § 417(e)(3) for distributions with annuity starting dates occurring during stability periods beginning in 2026 is set forth in the appendix to this notice in the column labeled “Unisex.” The mortality rates in this table are derived from the mortality tables specified under § 430(h)(3)(A) for 2026 in accordance with the procedures set forth in Rev. Rul. 2007-67.

Mortality Tables for 2026

Valuation Dates Occurring During 2026 and Distributions Subject to § 417(e)(3) with Annuity Starting Dates During Stability Periods Beginning in 2026

| 430(h)(3)(A) Static Tables | |||

|---|---|---|---|

| Age | Males | Females | Unisex |

| 0 | 0.00350 | 0.00302 | 0.00326 |

| 1 | 0.00024 | 0.00021 | 0.00023 |

| 2 | 0.00016 | 0.00013 | 0.00015 |

| 3 | 0.00012 | 0.00010 | 0.00011 |

| 4 | 0.00011 | 0.00007 | 0.00009 |

| 5 | 0.00009 | 0.00007 | 0.00008 |

| 6 | 0.00008 | 0.00006 | 0.00007 |

| 7 | 0.00007 | 0.00006 | 0.00007 |

| 8 | 0.00006 | 0.00005 | 0.00006 |

| 9 | 0.00005 | 0.00005 | 0.00005 |

| 10 | 0.00005 | 0.00005 | 0.00005 |

| 11 | 0.00005 | 0.00005 | 0.00005 |

| 12 | 0.00008 | 0.00006 | 0.00007 |

| 13 | 0.00010 | 0.00007 | 0.00009 |

| 14 | 0.00013 | 0.00008 | 0.00011 |

| 15 | 0.00017 | 0.00008 | 0.00013 |

| 16 | 0.00021 | 0.00009 | 0.00015 |

| 17 | 0.00025 | 0.00009 | 0.00017 |

| 18 | 0.00029 | 0.00010 | 0.00020 |

| 19 | 0.00033 | 0.00010 | 0.00022 |

| 20 | 0.00035 | 0.00010 | 0.00023 |

| 21 | 0.00036 | 0.00010 | 0.00023 |

| 22 | 0.00037 | 0.00011 | 0.00024 |

| 23 | 0.00037 | 0.00012 | 0.00025 |

| 24 | 0.00038 | 0.00014 | 0.00026 |

| 25 | 0.00039 | 0.00014 | 0.00027 |

| 26 | 0.00040 | 0.00014 | 0.00027 |

| 27 | 0.00042 | 0.00016 | 0.00029 |

| 28 | 0.00044 | 0.00016 | 0.00030 |

| 29 | 0.00045 | 0.00017 | 0.00031 |

| 30 | 0.00048 | 0.00018 | 0.00033 |

| 31 | 0.00050 | 0.00019 | 0.00035 |

| 32 | 0.00052 | 0.00020 | 0.00036 |

| 33 | 0.00056 | 0.00023 | 0.00040 |

| 34 | 0.00058 | 0.00024 | 0.00041 |

| 35 | 0.00061 | 0.00026 | 0.00044 |

| 36 | 0.00064 | 0.00028 | 0.00046 |

| 37 | 0.00066 | 0.00031 | 0.00049 |

| 38 | 0.00069 | 0.00032 | 0.00051 |

| 39 | 0.00071 | 0.00035 | 0.00053 |

| 40 | 0.00073 | 0.00036 | 0.00055 |

| 41 | 0.00074 | 0.00038 | 0.00056 |

| 42 | 0.00076 | 0.00040 | 0.00058 |

| 43 | 0.00078 | 0.00042 | 0.00060 |

| 44 | 0.00080 | 0.00045 | 0.00063 |

| 45 | 0.00082 | 0.00047 | 0.00065 |

| 46 | 0.00087 | 0.00050 | 0.00069 |

| 47 | 0.00091 | 0.00054 | 0.00073 |

| 48 | 0.00096 | 0.00058 | 0.00077 |

| 49 | 0.00103 | 0.00063 | 0.00083 |

| 50 | 0.00111 | 0.00069 | 0.00090 |

| 51 | 0.00122 | 0.00078 | 0.00100 |

| 52 | 0.00135 | 0.00089 | 0.00112 |

| 53 | 0.00151 | 0.00099 | 0.00125 |

| 54 | 0.00170 | 0.00113 | 0.00142 |

| 55 | 0.00203 | 0.00136 | 0.00170 |

| 56 | 0.00249 | 0.00167 | 0.00208 |

| 57 | 0.00291 | 0.00192 | 0.00242 |

| 58 | 0.00339 | 0.00222 | 0.00281 |

| 59 | 0.00390 | 0.00254 | 0.00322 |

| 60 | 0.00451 | 0.00294 | 0.00373 |

| 61 | 0.00515 | 0.00338 | 0.00427 |

| 62 | 0.00605 | 0.00402 | 0.00504 |

| 63 | 0.00692 | 0.00471 | 0.00582 |

| 64 | 0.00762 | 0.00528 | 0.00645 |

| 65 | 0.00847 | 0.00610 | 0.00729 |

| 66 | 0.00942 | 0.00696 | 0.00819 |

| 67 | 0.01038 | 0.00774 | 0.00906 |

| 68 | 0.01144 | 0.00857 | 0.01001 |

| 69 | 0.01263 | 0.00952 | 0.01108 |

| 70 | 0.01398 | 0.01066 | 0.01232 |

| 71 | 0.01551 | 0.01197 | 0.01374 |

| 72 | 0.01722 | 0.01347 | 0.01535 |

| 73 | 0.01919 | 0.01515 | 0.01717 |

| 74 | 0.02141 | 0.01715 | 0.01928 |

| 75 | 0.02396 | 0.01944 | 0.02170 |

| 76 | 0.02687 | 0.02206 | 0.02447 |

| 77 | 0.03021 | 0.02501 | 0.02761 |

| 78 | 0.03407 | 0.02833 | 0.03120 |

| 79 | 0.03852 | 0.03204 | 0.03528 |

| 80 | 0.04373 | 0.03657 | 0.04015 |

| 81 | 0.04931 | 0.04093 | 0.04512 |

| 82 | 0.05561 | 0.04578 | 0.05070 |

| 83 | 0.06273 | 0.05121 | 0.05697 |

| 84 | 0.07081 | 0.05732 | 0.06407 |

| 85 | 0.08006 | 0.06426 | 0.07216 |

| 86 | 0.09051 | 0.07227 | 0.08139 |

| 87 | 0.10226 | 0.08138 | 0.09182 |

| 88 | 0.11542 | 0.09183 | 0.10363 |

| 89 | 0.12991 | 0.10352 | 0.11672 |

| 90 | 0.14568 | 0.11656 | 0.13112 |

| 91 | 0.16231 | 0.13002 | 0.14617 |

| 92 | 0.17934 | 0.14406 | 0.16170 |

| 93 | 0.19669 | 0.15865 | 0.17767 |

| 94 | 0.21410 | 0.17355 | 0.19383 |

| 95 | 0.23144 | 0.18885 | 0.21015 |

| 96 | 0.24977 | 0.20520 | 0.22749 |

| 97 | 0.26837 | 0.22221 | 0.24529 |

| 98 | 0.28726 | 0.23999 | 0.26363 |

| 99 | 0.30664 | 0.25840 | 0.28252 |

| 100 | 0.32616 | 0.27739 | 0.30178 |

| 101 | 0.34569 | 0.29680 | 0.32125 |

| 102 | 0.36491 | 0.31628 | 0.34060 |

| 103 | 0.38377 | 0.33576 | 0.35977 |

| 104 | 0.40229 | 0.35515 | 0.37872 |

| 105 | 0.41993 | 0.37436 | 0.39715 |

| 106 | 0.43708 | 0.39316 | 0.41512 |

| 107 | 0.45333 | 0.41147 | 0.43240 |

| 108 | 0.46890 | 0.42899 | 0.44895 |

| 109 | 0.48380 | 0.44578 | 0.46479 |

| 110 | 0.49309 | 0.46181 | 0.47745 |

| 111 | 0.49433 | 0.47708 | 0.48571 |

| 112 | 0.49557 | 0.49146 | 0.49352 |

| 113 | 0.49686 | 0.49761 | 0.49724 |

| 114 | 0.49820 | 0.49860 | 0.49840 |

| 115 | 0.49945 | 0.49960 | 0.49953 |

| 116 | 0.49970 | 0.49980 | 0.49975 |

| 117 | 0.49985 | 0.49990 | 0.49988 |

| 118 | 0.49990 | 0.50000 | 0.49995 |

| 119 | 0.50000 | 0.50000 | 0.50000 |

| 120 | 1.00000 | 1.00000 | 1.00000 |

1 Section 430(h)(3)(C) provides that, upon request by a plan sponsor and approval by the Secretary, substitute mortality tables that meet the applicable requirements may be used in lieu of the standard mortality tables provided under § 430(h)(3)(A). Section 430(h)(3)(D) provides for the use of separate mortality tables with respect to certain individuals who are entitled to benefits on account of disability.

The Office of Professional Responsibility (OPR) announces recent disciplinary sanctions imposed on attorneys, certified public accountants, enrolled agents, enrolled actuaries, enrolled retirement plan agents, and appraisers. The OPR also announces when certain unenrolled, unlicensed tax return preparers (individuals who are not enrolled to practice before the Internal Revenue Service (IRS) and are not licensed as attorneys or certified public accountants) have been disciplined. Licensed or enrolled practitioners are subject to the regulations governing practice before the IRS, which are set out in Title 31, Code of Federal Regulations, Subtitle A, Part 10, and which are released as Treasury Department Circular No. 230. The regulations prescribe the duties and restrictions relating to such practice and prescribe the disciplinary sanctions for violating the regulations. Unenrolled/unlicensed return preparers who choose to participate in the IRS’s voluntary Annual Filing Season Program (AFSP) are subject to the guidance in Revenue Procedure 2014-42, which governs a preparer’s eligibility to represent taxpayers before the IRS in examinations of tax returns the preparer both prepared for the taxpayer and signed as the preparer. Additionally, unenrolled/unlicensed return preparers who participate in the AFSP agree to be subject to the duties and restrictions in Circular 230, including the restrictions on incompetence or disreputable conduct.

The disciplinary sanctions imposed for violation of the applicable standards are:

Disbarred from practice before the IRS—An individual who is disbarred is not eligible to practice before the IRS as defined at 31 C.F.R. § 10.2(a)(4) for a minimum period of five (5) years and until reinstated to practice.

Suspended from practice before the IRS—An individual who is suspended is not eligible to practice before the IRS as defined at 31 C.F.R. § 10.2(a)(4) during the term of the suspension and until reinstated to practice.

Censured—Censure is a public reprimand. Unlike disbarment or suspension, censure does not affect an individual’s eligibility to practice before the IRS, but the OPR may subject the individual’s future practice rights to conditions designed to promote high standards of conduct.

Monetary penalty—A monetary penalty may be imposed on an individual who engages in conduct subject to sanction, or on an employer, firm, or other entity if the individual was acting on its behalf and it knew, or reasonably should have known, of the individual’s conduct.

Disqualification of appraiser—An appraiser who is disqualified is barred from presenting evidence or testimony in any administrative proceeding before the Department of the Treasury or the IRS. Additionally, any appraisal made by the disqualified appraiser after the effective date of disqualification will not have any probative effect in any administrative proceeding before the Treasury Department or the IRS.

Ineligible for limited practice—An unenrolled/unlicensed tax return preparer who participates in the AFSP and who fails to comply with Circular 230 as required by Revenue Procedure 2014-42 may have their AFSP credential revoked and may be determined ineligible to engage in future limited practice under the program as a representative of a taxpayer.

Under the regulations, individuals subject to Circular 230 may not assist, or accept assistance from, individuals who are suspended or disbarred with respect to matters constituting practice (i.e., representation) before the IRS, and they may not aid or abet suspended or disbarred individuals to practice before the IRS.

Disciplinary sanctions are described in these terms:

Disbarred by decision, Suspended by decision, Censured by decision, Monetary penalty imposed by decision, and Disqualified by decision (including after a hearing)—An administrative law judge (ALJ), upon the OPR’s complaint alleging violation of the regulations, issued a decision imposing one of these sanctions after the ALJ either (1) granted the government’s motion for summary adjudication or (2) after conducting an evidentiary hearing. After 30 days from the issuance of the decision, in the absence of an appeal, the ALJ’s decision becomes the final agency decision.

Disbarred by default decision, Suspended by default decision, Censured by default decision, Monetary penalty imposed by default decision, and Disqualified by default decision—An ALJ, after finding that no answer to the OPR’s complaint was filed or timely filed, granted the OPR’s motion for a default judgment and issued a decision imposing one of these sanctions.

Disbarred by decision on appeal, Suspended by decision on appeal, Censured by decision on appeal, Monetary penalty imposed by decision on appeal, and Disqualified by decision on appeal—The decision of the ALJ was appealed to the agency’s appellate authority, acting as the delegate of the Secretary of the Treasury, and the appellate authority issued a decision imposing one of these sanctions.

Disbarred by consent, Suspended by consent, Censured by consent, Monetary penalty imposed by consent, and Disqualified by consent—In lieu of a disciplinary proceeding being instituted or continued, an individual offered their consent to one of these sanctions (or a firm or other entity offered to consent to a monetary penalty) and the OPR accepted the offer and the parties entered into a consent agreement. Typically, an offer of consent will provide for: suspension for an indefinite term; conditions that the individual must observe during the suspension; and the individual’s opportunity, after a stated number of months, to file with the OPR a petition for reinstatement affirming compliance with the terms of the consent agreement and affirming current fitness and eligibility to practice (i.e., an active professional license or active enrollment status, with no intervening violations of the regulations).

Suspended indefinitely by decision in expedited proceeding, Suspended indefinitely by default decision in expedited proceeding—The OPR instituted an expedited proceeding for suspension (based on certain limited grounds, including loss of a professional license for cause, and criminal convictions) that resulted in suspension.

Determined ineligible for limited practice—There has been a final determination under Revenue Procedure 2014-42 that an unenrolled/unlicensed tax return preparer is not eligible for continued limited representation of taxpayers because the preparer violated standards of conduct prescribed in Circular 230 or failed to comply with any of the requirements described in the revenue procedure.

A practitioner who has been disbarred or suspended under 31 C.F.R. § 10.60, or suspended under § 10.82, or a disqualified appraiser may petition for reinstatement before the IRS after the expiration of 5 years following such disbarment, suspension, or disqualification (or immediately following the expiration of the suspension or disqualification period if shorter than 5 years). Reinstatement will not be granted unless the IRS is satisfied that the petitioner is not likely to engage thereafter in conduct contrary to Circular 230, and that granting such reinstatement would not be contrary to the public interest.

Reinstatement decisions are published at the individual’s request, and described in these terms:

Reinstated to practice before the IRS—The OPR granted the individual’s petition for reinstatement. The individual is eligible to practice before the IRS, or in the case of an appraiser, the individual is no longer disqualified.

The OPR has authority to disclose the grounds for disciplinary sanctions in these situations: (1) an ALJ or the Secretary’s delegate on appeal has issued a final decision imposing a sanction; (2) the individual has settled a disciplinary case by signing the OPR’s consent-to-sanction agreement admitting to one or more violations of the regulations and consenting to the disclosure of the admitted violations (for example, willful failure to file Federal income tax returns, lack of due diligence, conflict of interest, etc.); (3) that the OPR has issued a decision in an expedited proceeding for indefinite suspension; or (4) upon a final determination (including any decision on appeal) that an unenrolled/unlicensed return preparer is no longer eligible to represent taxpayers before the IRS under Revenue Procedure 2014-42.

Announcements of disciplinary sanctions appear in the Internal Revenue Bulletin at the earliest practicable date. The sanctions announced below are alphabetized first by state and second by the last names of the sanctioned individuals.

| City & State | Name | Professional Designation | Disciplinary Sanction | Effective Date(s) |

|---|---|---|---|---|

| Florida | ||||

| Naples | Anderson, Ralph J. | CPA | Suspended by consent for admitted violations of 31 C.F.R. § 10.51(a)(2) and 10.51 (a)(10) | Indefinite from June 23, 2025 |

| Georgia | ||||

| Peachtree Corners | Lewis, Herbert E. | CPA | Suspended by default decision in expedited proceeding under 31 C.F.R. § 10.82(b) | Indefinite from April 21, 2025 |

| Illinois | ||||

| Granville | Wilson, Holly M. | Enrolled Agent | Suspended by consent for admitted violations of 31 C.F.R. § 10.51(a)(2) | Indefinite from April 7, 2025 |

| Michigan | ||||

| West Bloomfield | Freeman, Jeffrey S. | Attorney | Suspended by default decision in expedited proceeding under 31 C.F.R. § 10.82(b) | Indefinite from May 21, 2025 |

| Puerto Rico | ||||

| San German | Martinez-Rodriguez, Milton E. | Appraiser | Suspended by consent for admitted violations of 31 C.F.R. § 10.22(a)(1) | Indefinite from April 25, 2025 |

| Part 1 – GENERAL | |

|---|---|

| Section 1.1 – Purpose | 274 |

| Section 1.2 – What’s New | 276 |

| Section 1.3 – Reminders | 276 |

| Section 1.4 – General Rules for Paper Forms W-2 and W-3 | 277 |

| Section 1.5 – General Rules for Filing Forms W-2 (Copy A) Electronically | 279 |

| PART 2 – SPECIFICATIONS FOR SUBSTITUTE FORMS W-2 AND W-3 | |

| Section 2.1 – Specifications for Red-Ink Substitute Form W-2 (Copy A) and Form W-3 Filed With the SSA | 279 |

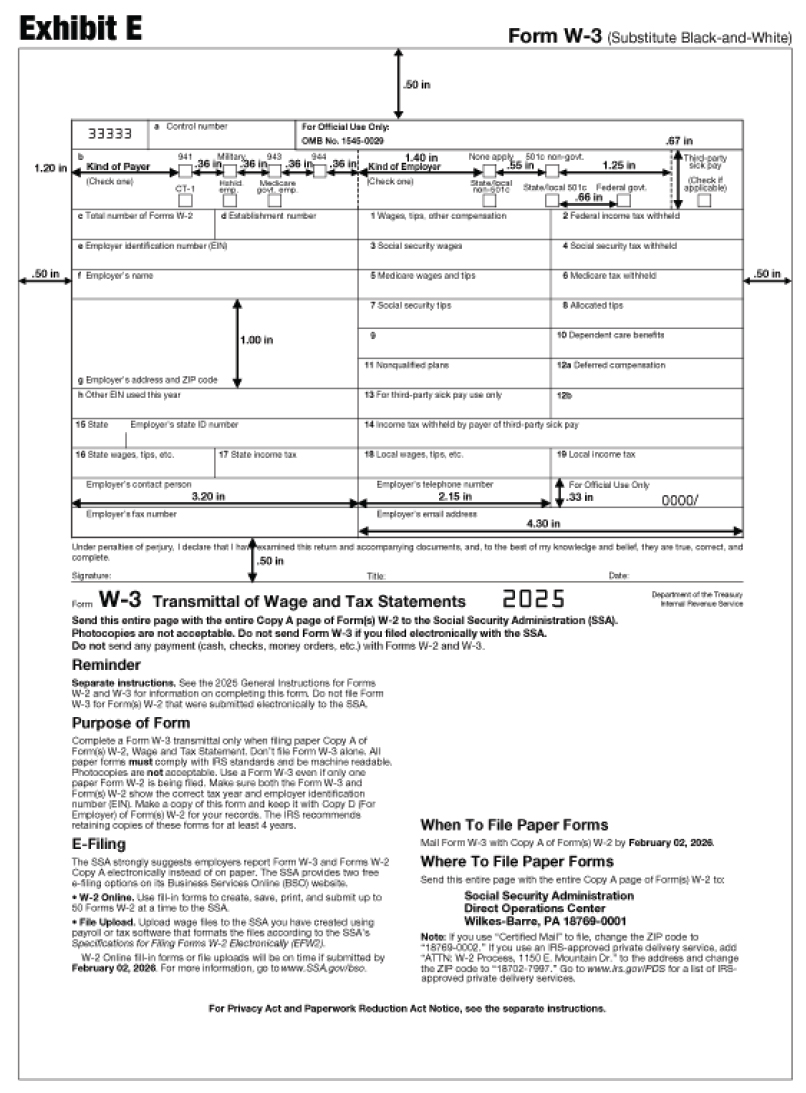

| Section 2.2 – Specifications for Substitute Black-and-White Form W-2 (Copy A) and Form W-3 Filed With the SSA | 282 |

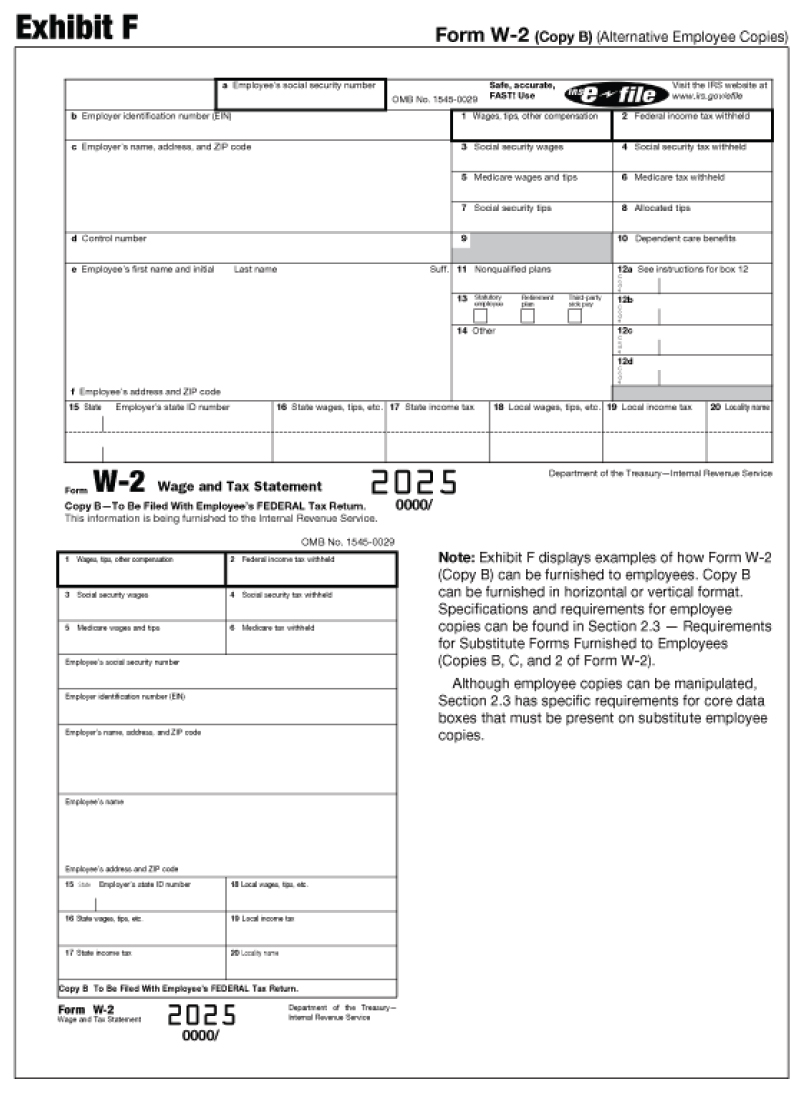

| Section 2.3 – Requirements for Substitute Forms Furnished to Employees (Copies B, C, and 2 of Form W-2) | 285 |

| Section 2.4 – Electronic Delivery of Forms W-2 and W-2c Recipient Statements | 288 |

| PART 3 – ADDITIONAL INSTRUCTIONS | |

| Section 3.1 – Additional Instructions for Form Printers | 290 |

| Section 3.2 – Instructions for Employers | 290 |

| Section 3.3 – OMB Requirements for Both Red-Ink and Black-and-White Substitute Forms W-2 and W-3 | 291 |

| Section 3.4 – Order Forms and Instructions | 292 |

| Section 3.5 – Effect on Other Documents | 292 |

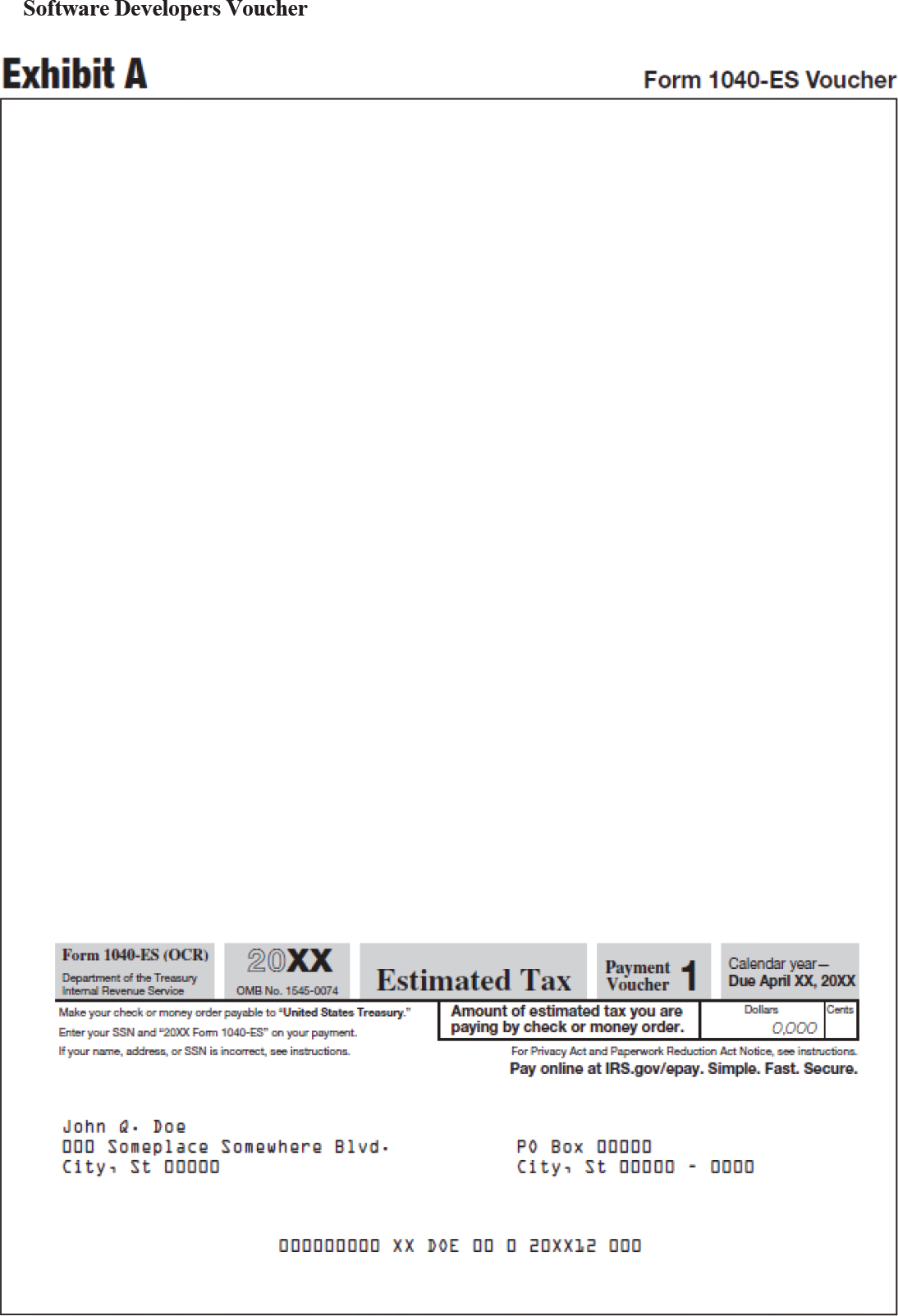

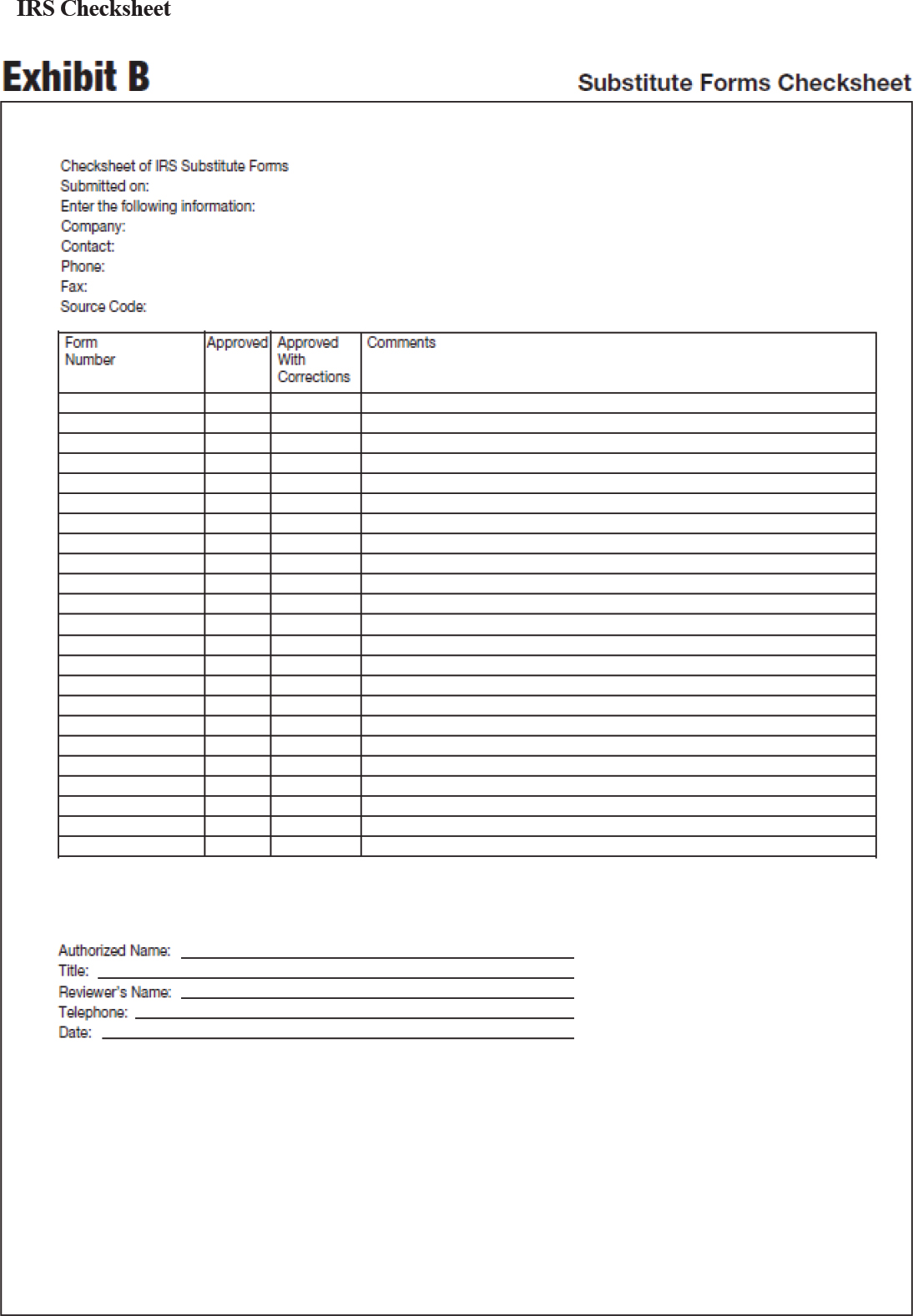

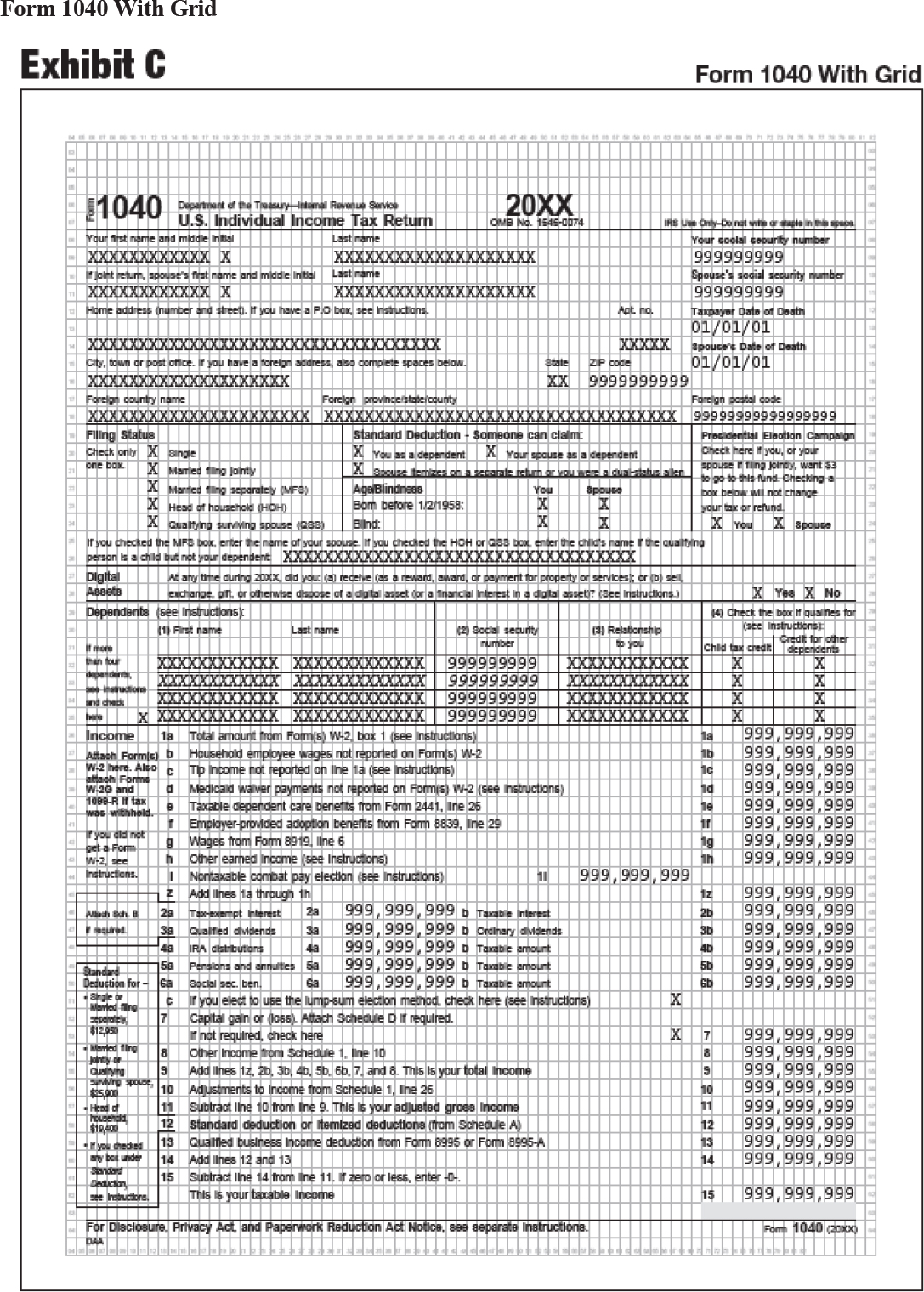

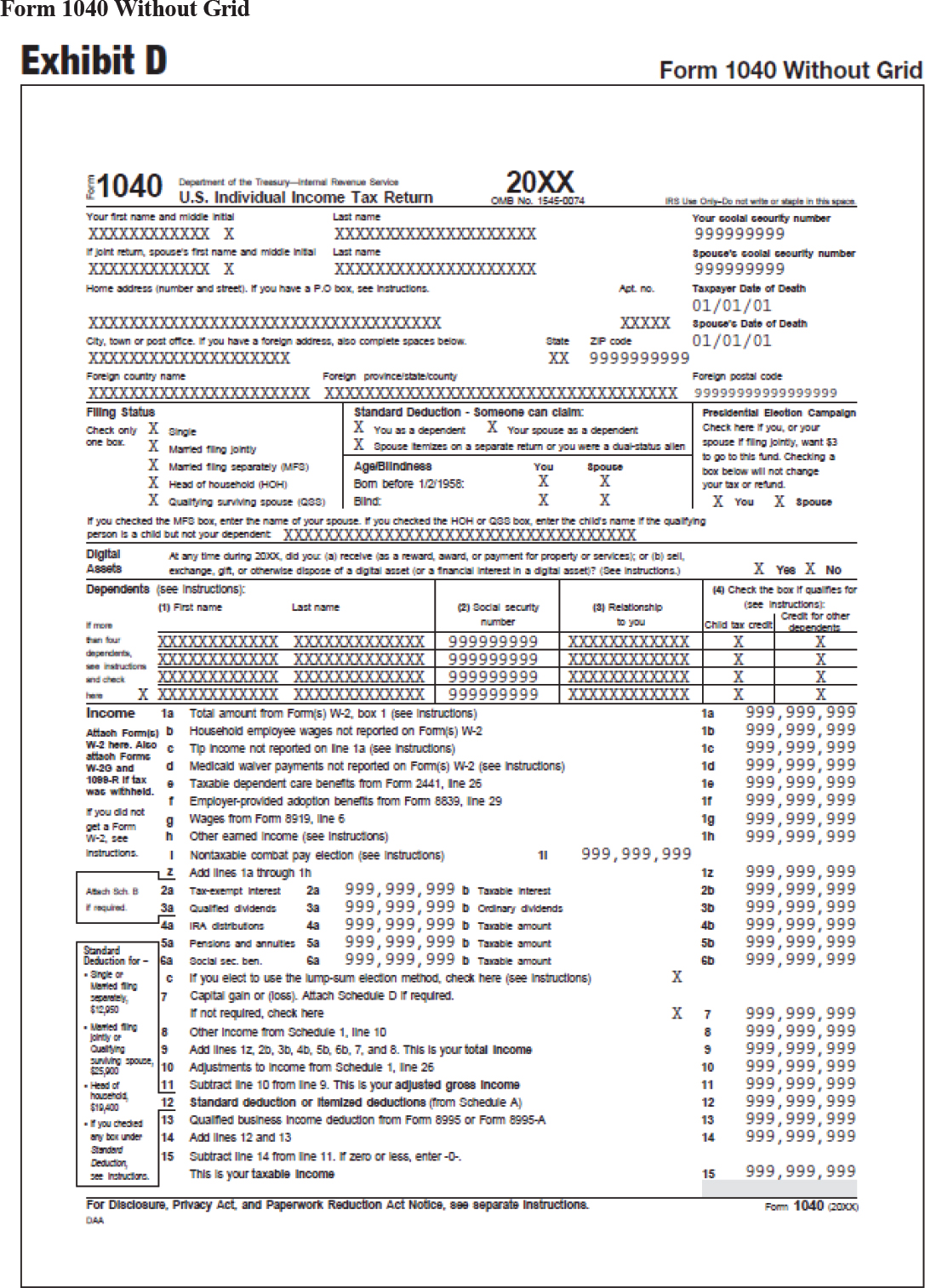

| Section 3.6 – Exhibits | 292 |

.01 The purpose of this revenue procedure is to state the requirements of the Internal Revenue Service (IRS) and the Social Security Administration (SSA) regarding the preparation and use of substitute forms for Form W-2, Wage and Tax Statement, and Form W-3, Transmittal of Wage and Tax Statements, for wages paid during the 2025 calendar year.

.02 For purposes of this revenue procedure, substitute Form W-2 (Copy A) and substitute Form W-3 are forms that are not printed by the IRS. Copy A or any other copies of a substitute Form W-2 or a substitute Form W-3 must conform to the specifications in this revenue procedure to be acceptable to the IRS and the SSA. No IRS office is authorized to allow deviations from this revenue procedure. Preparers should also refer to the 2025 General Instructions for Forms W-2 and W-3 for details on how to complete these forms. See Section 3.4, later, for information on obtaining the official IRS forms and instructions. See Sections 2.3 and 2.4, later, for requirements for the copies of substitute forms furnished to employees and for electronic delivery of employee copies.

.03 For purposes of this revenue procedure, the official IRS-printed red dropout ink Forms W-2 (Copy A) and Form W-3, and their exact substitutes, are referred to as “red-ink.” The SSA-approved black-and-white Forms W-2 (Copy A) and Form W-3 are referred to as “substitute black-and-white Forms W-2 (Copy A)” and “substitute black-and-white Form W-3,” respectively.

Any questions about the red-ink Form W-2 (Copy A) and Form W-3 and the substitute employee statements should be emailed to substituteforms@irs.gov. Please enter “Substitute Forms” on the subject line. Or send your questions to:

Internal Revenue Service

Attn: Substitute Forms Program

C:DC:TS:CAR:MP:P:TP:TP

ATSC

4800 Buford Highway

Mail Stop 061-N

Chamblee, GA 30341

Note. Do not send completed forms to the Substitute Forms Program via email or mail as they are unable to process those forms. Any examples/samples of substitute forms sent to the Substitute Forms Program should not contain taxpayer information.

Any questions about the black-and-white Form W-2 (Copy A) and Form W-3 should be emailed to copy.a.forms@ssa.gov or sent to:

Social Security Administration

Direct Operations Center

Attn: Substitute Black-and-White Copy A Forms, Room 341

1150 E. Mountain Drive

Wilkes-Barre, PA 18702-7997

Note. You should receive a response from either the IRS or the SSA within 30 days.

.04 Forms W-2 and envelopes containing Forms W-2 that include logos, slogans, and advertisements (including advertisements for tax preparation software) may be considered as suspicious or altered Forms W-2 (also known as questionable Forms W-2). An employee may not recognize the importance (or legitimacy) of the employee copy for tax reporting purposes due to the use of logos, slogans, and advertisements. Thus, the IRS has determined that logos, slogans, and advertising will not be allowed on Copy A of Forms W-2, Forms W-3, or any employee copies reporting wages, or on an envelope or enclosed in an envelope containing any of those documents, with the following exceptions for the employee copies.

-

Forms and envelopes may include the exact name of the employer or agent, primary trade name, trademark, service mark, or symbol of the employer or agent.

-

Forms and envelopes may include an embossment or watermark on the information return (and copies) that is a representation of the name, a primary trade name, trademark, service mark, or symbol of the employer or agent.

-

Presentation may be in any typeface, font, stylized fashion, or print color normally used by the employer or agent, and used in a nonintrusive manner.

-

These items must not materially interfere with the ability of the recipient to recognize, understand, and use the tax information on the employee copies.

The IRS e-file logo on the IRS official employee copies may be included, but it is not required, on any of the substitute form copies.

The information return and employee copies must clearly identify the employer’s name associated with its employer identification number (EIN).

Logos and slogans may be used on permissible enclosures, such as a check or account statement, but not on information returns and employee copies.

Forms W-2 and W-3 are subject to annual review and possible change. This revenue procedure may be revised to state other requirements of the IRS and the SSA regarding the preparation and use of substitute forms for Form W-2 and Form W-3 for wages paid during the 2025 calendar year at a future date. If you have comments about the restrictions on including logos, slogans, and advertising on information returns and employee copies, send or email your comments to Internal Revenue Service, Attn: Substitute Forms Program, C:DC:TS:CAR:MP:P:TP:TP, ATSC, 4800 Buford Highway, Mail Stop 061-N, Chamblee, GA 30341, or substituteforms@irs.gov.

.05 The Internal Revenue Service/Technical Service Operation (IRS/TSO) maintains a centralized customer service call site to answer questions related to information returns (Forms W-2, W-3, W-2c, W-3c, 1099 series, 1096, etc.). You can reach the TSO at 866-455-7438 (toll free) or 304-263-8700 (not a toll-free number). Deaf or hard-of-hearing customers may call any of our toll-free numbers using their choice of relay service. Questions regarding the filing of information returns can be emailed to fire@irs.gov. When you send emails concerning specific file information, include the company name and the electronic file name or Transmitter Control Code (TCC). Do not include taxpayer identification numbers (TINs) or attachments in email correspondence because electronic mail is not secure.

File paper or electronic Forms W-2 (Copy A) with the SSA. The IRS/TSO does not process Forms W-2 (Copy A). However, the IRS/TSO does process Form 8508, Application for a Waiver from Electronic Filing of Information Returns, and Form 8809, Application for Extension of Time To File Information Returns, for Forms W-2 (Copy A) and Form 15397, Application for Extension of Time to Furnish Recipient Statements. See Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G, for information on waivers and extensions of time. See Regulations section 301.6011-2 for information on when you are required to file electronically and the exclusions from the electronic filing requirements.

.06 The following form instructions and publications provide more detailed filing procedures for certain information returns.

-

General Instructions for Forms W-2 and W-3 (Including Forms W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2c, and W-3c).

-

Publication 1223, General Rules and Specifications for Substitute Forms W-2c and W-3c.

.01 Forms W-2, W-2AS, W-2GU, W-2VI, W-3, W-3SS, W-2c, and W-3c have been updated for a new OMB Number. All of the 2025 Forms W-2, W-2AS, W-2GU, W-2VI, W-3, and W-3SS have been updated to show the new OMB Number 1545-0029.

In addition, updated Forms W-2c and W-3c were released in June of 2024. The forms have a revision date (Rev. 6-2024) to the right of the bold W-2c or W-3c. These forms have been updated for the new OMB Number 1545-0029.

.02 IRS address change. Inquiries about the red-ink Form W-2 (Copy A) and Form W-3 should be sent to the IRS at Internal Revenue Service, Attn: Substitute Forms Program, C:DC:TS:CAR:MP:P:TP:TP, ATSC, 4800 Buford Highway, Mail Stop 061-N, Chamblee, GA 30341.

.03 New procedure to request an extension of time to furnish recipient copies of Form W-2. Complete Form 15397, Application for Extension of Time to Furnish Recipient Statements, to request an extension of time for furnishing Copies 2, B, and C to employees. See Form 15397 for more information.

.04 Exhibits. All of the exhibits in this publication were updated per the 2025 revisions of those forms.

.05 Editorial changes. We made editorial changes throughout, including updated references. Redundancies were eliminated as much as possible.

.01 Electronic filing of returns. If you file 10 or more information returns, you must file electronically. See Regulations section 301.6011-2 for more information, including exclusions from the electronic filing requirements.

.01 Employers not filing electronically must file paper Forms W-2 (Copy A) along with Form W-3 with the SSA by using either the official IRS form or a substitute form that exactly meets the specifications shown in Parts 2 and 3 of this revenue procedure.

Note. Substitute territorial forms (W-2AS, W-2GU, W-2VI, W-3SS) must also conform to the specifications as outlined in this revenue procedure. These forms require the form designation (“W-2AS,” “W-2GU,” “W-2VI”) on Form W-2 (Copy A) to be in black ink. If you are an employer in the Commonwealth of the Northern Mariana Islands, you must contact Department of Finance, Division of Revenue and Taxation, Commonwealth of the Northern Mariana Islands, P.O. Box 5234 CHRB, Saipan, MP 96950 or www.finance.gov.mp/forms.php to get Form W-2CM and instructions for completing and filing the form. For information on Forms 499R-2/W-2PR, go to www.hacienda.pr.gov.

Employers may design their own statements to furnish to employees. Employee statements designed by employers must comply with the requirements shown in Parts 2 and 3.

.02 Red-ink substitute forms that completely conform to the specifications contained in this revenue procedure may be privately printed without prior approval from the IRS or the SSA. Only the substitute black-and-white Forms W-2 (Copy A) and Form W-3 need to be submitted to the SSA for approval prior to their use (see Section 2.2).

.03 SSA-approved black-and-white Forms W-2 (Copy A) and Form W-3 may be generated using a printer by following all guidelines and specifications (also see Section 2.2). In general, regardless of the method of entering data, use black ink on Forms W-2 (Copy A) and Form W-3, which provides better readability for processing by scanning equipment. Colors other than black are not easily read by the scanner and may result in delays or errors in the processing of Forms W-2 (Copy A) and Form W-3. The printing of the data should be centered within the boxes. The size of the variable data must be printed in a font no smaller than 10 points.

Note. With the exception of the identifying number, the year, the form number for Form W-3, and the corner register marks, the preprinted form layout for the red-ink Forms W-2 (Copy A) and Form W-3 must be in Flint J-6983 red OCR dropout ink or an exact match.

.04 Substitute forms filed with the SSA and substitute copies furnished to employees that do not conform to these specifications are unacceptable. Penalties may be assessed for not complying with the form specifications. Forms W-2 (Copy A) and Form W-3 filed with the SSA that do not conform may be returned.

.05 Substitute red-ink forms should not be submitted to either the IRS or the SSA for specific approval. If you are uncertain of any specification and want clarification, do the following.

-

Submit a letter or email to the appropriate address in Section 1.4.06 (listed next) citing the specification.

-

State your understanding of the specification.

-

Enclose an example (if appropriate) of how the form would appear if produced using your understanding. Do not use actual employee information in the example.

-

Be sure to include your name, complete address, and phone number with your correspondence. If you want the IRS to contact you via email, also provide your email address.

.06 Any questions about the specifications, especially those for the red-ink Form W-2 (Copy A) and Form W-3, should be emailed to substituteforms@irs.gov. Please enter “Substitute Forms” on the subject line. Or send your questions to:

Internal Revenue Service

Attn: Substitute Forms Program

C:DC:TS:CAR:MP:P:TP:TP

ATSC

4800 Buford Highway

Mail Stop 061-N

Chamblee, GA 30341

Note. Do not send completed forms to the Substitute Forms Program via email or mail as they are unable to process those forms. Any examples/samples of substitute forms sent to the Substitute Forms Program should not contain taxpayer information.

Any questions about the substitute black-and-white Form W-2 (Copy A) and Form W-3 should be emailed to copy.a.forms@ssa.gov or sent to:

Social Security Administration

Direct Operations Center

Attn: Substitute Black-and-White Copy A Forms, Room 341

1150 E. Mountain Drive

Wilkes-Barre, PA 18702-7997

Note. You should receive a response within 30 days from either the IRS or the SSA.

.07 Forms W-2 and W-3 are subject to annual review and possible change. Therefore, employers are cautioned against overstocking supplies of privately printed substitutes.

.08 Separate instructions for Forms W-2 and W-3 are provided in the 2025 General Instructions for Forms W-2 and W-3. Form W-3 should be used only to transmit paper Forms W-2 (Copy A). Form W-3 is a single sheet including only essential filing information. Be sure to make a copy of your completed Form W-3 for your records. You can order current year official IRS Forms W-2, W-2AS, W-2GU, W-2VI, W-3, and W-3SS, and the 2025 General Instructions for Forms W-2 and W-3, online at IRS.gov/OrderForms. The IRS provides only cut sheet sets of Forms W-2 and cut sheets of Form W-3.

.09 Because substitute Forms W-2 (Copy A) and Form W-3 are machine imaged and scanned by the SSA, the forms must meet the same specifications as the official IRS Forms W-2 and Form W-3 (as shown in the exhibits).

.01 Employers must file Forms W-2 (Copy A) with the SSA electronically if they are required to file 10 or more information returns unless the IRS grants a waiver or the employer claims an exemption from the electronic filing requirement. See Regulations section 301.6011-2 for more information. The SSA publication EFW2, Specifications for Filing Forms W-2 Electronically, contains specifications and procedures for electronic filing of Form W-2 information with the SSA. Employers are cautioned to obtain the most recent revision of EFW2 (and supplements) in case there are any subsequent changes in specifications and procedures.

.02 You may obtain a copy of the EFW2 by accessing the SSA website at www.ssa.gov/employer/EFW2&EFW2C.htm.

.03 Electronic filers do not file a paper Form W-3. See the SSA publication EFW2 for guidance on transmitting Form W-2 (Copy A) information to the SSA electronically.

.04 Employers are encouraged to electronically file Forms W-2 (Copy A) with the SSA even if not required. Doing so will enhance the timeliness and accuracy of forms processing. You may visit the SSA’s employer website at www.ssa.gov/employer. This helpful site has links to Business Services Online (BSO) and tutorials on creating an account and using BSO to file your Forms W-2.

.05 Employers who do not comply with the electronic filing requirements for Form W-2 (Copy A) and who are not granted a waiver by or claim an exemption from the IRS may be subject to penalties. Employers who file Form W-2 information with the SSA electronically must not send the same data to the SSA on paper Forms W-2 (Copy A). Any duplicate reporting may subject filers to unnecessary contacts by the SSA or the IRS.

.01 The official IRS-printed red dropout ink Form W-2 (Copy A) and Form W-3 and their exact substitutes are referred to as “red-ink” in this revenue procedure. Employers may file substitute Forms W-2 (Copy A) and Form W-3 with the SSA. The substitute forms must be exact replicas of the official IRS forms with respect to layout and content because they will be read by scanner equipment.

Note. Even the slightest deviation can result in incorrect scanning and may affect money amounts reported for employees.

.02 Paper used for cut sheets and continuous-pinfed forms for substitute Forms W-2 (Copy A) and Form W-3 that are to be filed with the SSA must be white 100% bleached chemical wood, 18–20 pound paper only, optical character recognition (OCR) bond produced in accordance with the following specifications.

| • Acidity: Ph value, average, not less than . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 4.5 |

| • Basis weight: 17 x 22 inch 500 cut sheets, pound . . . . . . . . . . . . . . . . . . . . | 18–20 |

| • Metric equivalent—gm./sq. meter (a tolerance of +5 pct. is allowed) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 68–75 |

| • Stiffness: Average, each direction, not less than—milligrams Cross direction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 50 |

| Machine direction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 80 |

| Tearing strength: Average, each direction, not less than—grams . . . . . . . . | 40 |

| • Opacity: Average, not less than—percent . . . . . . . . . . . . . . . . . . . . . . . . . . | 82 |

| • Reflectivity: Average, not less than—percent . . . . . . . . . . . . . . . . . . . . . . . | 68 |

| • Thickness: Average—inch . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 0.0038 |

| Metric equivalent—mm . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 0.097 |

| (a tolerance of +0.0005 inch (0.0127 mm) is allowed). Paper cannot vary more than 0.0004 inch (0.0102 mm) from one edge to the other. | |

| • Porosity: Average, not less than—seconds . . . . . . . . . . . . . . . . . . . . . . . . . | 10 |

| • Finish (smoothness): Average, each side—seconds . . . . . . . . . . . . . . . . . . | 20–55 |

| (for information only) the Sheffield equivalent—units . . . . . . . . . . . . . . . . | 170-d200 |

| • Dirt: Average, each side, not to exceed—parts per million . . . . . . . . . . . . . | 8 |

Note. Reclaimed fiber in any percentage is permitted, provided the requirements of this standard are met.

.03 All printing of red-ink substitute Forms W-2 (Copy A) and Form W-3 must be in Flint red OCR dropout ink except as specified below. The following must be printed in nonreflective black ink.

-

Identifying number “22222” for Forms W-2 (Copy A) and “33333” for Form W-3 at the top of the forms.

-

Tax year at the bottom of the forms.

-

The four (4) corner register marks on the forms.

-

The form identification number (“W-3”) at the bottom of Form W-3.

-

All the instructions below Form W-3 beginning with “Send this entire page. . . .” line to the bottom of Form W-3.

.04 The vertical and horizontal spacing for all federal payment and data boxes on Forms W-2 and W-3 must meet specifications. On Form W-3 and Form W-2 (Copy A), all the perimeter rules must be 1 point (0.014 inch), while all other rules must be one-half point (0.007 inch). Vertical rules must be parallel to the left edge of the form; horizontal rules parallel to the top edge.

.05 The official red-ink Form W-3 and Form W-2 (Copy A) are 7.50 inches wide. Employers filing Forms W-2 (Copy A) with the SSA on paper must also file a Form W-3. Form W-3 must be the same width (7.50 inches) as the Form W-2. One Form W-3 is printed on a standard size 8.5 x 11-inch page. Two official Forms W-2 (Copy A) are contained on a single 8.5 x 11-inch page (exclusive of any snap-stubs).

.06 The top, left, and right margins for the Form W-2 (Copy A) and Form W-3 are 0.50 inches (1/2 inch). All margins must be free of printing except for the words “DO NOT STAPLE” on red-ink Form W-3. The space between the two Forms W-2 (Copy A) is 1.33 inches.

.07 The identifying numbers are “22222” for Form W-2 (Copy A (and 1)) and “33333” for Form W-3. No printing should appear anywhere near the identifying numbers.

Note. The identifying number must be printed in nonreflective black ink in OCR-A font of 10 characters per inch.

.08 The depth of the individual scannable image on a page must be the same as that on the official IRS forms. The depth from the top line to the bottom line of an individual Form W-2 (Copy A) must be 4.17 inches and the depth from the top line to the bottom line of Form W-3 must be 4.67 inches.

.09 Continuous-pinfed Forms W-2 (Copy A) must be separated into 11-inch-deep pages. The pinfed strips must be removed when Forms W-2 (Copy A) are filed with the SSA. The two Forms W-2 (Copy A) on the 11-inch page must not be separated (only the pages are to be separated (burst)). The words “Do Not Cut, Fold, or Staple Forms on This Page” must be printed twice between the two Forms W-2 (Copy A) in Flint red OCR dropout ink. All other copies (Copies 1, B, C, 2, and D) must be able to be distinguished and separated into individual forms.

.10 Box 12 of Form W-2 (Copy A) contains four entry boxes—12a, 12b, 12c, and 12d. Do not make more than one entry per box. Enter your first code in box 12a (for example, enter code D in box 12a, not 12d, if it is your first entry). If more than four items need to be reported in box 12, use a second Form W-2 to report the additional items (see Multiple forms in the 2025 General Instructions for Forms W-2 and W-3). Do not report the same federal tax data to the SSA on more than one Form W-2 (Copy A). However, repeat the identifying information (employee’s name, address, and social security number (SSN); employer’s name, address, and EIN) on each additional form.

.11 The checkboxes in box 13 of Form W-2 (Copy A) and in box b of Form W-3 must be 0.14 inches each. The space before the first checkbox is 0.24 inches; the spaces between the first and second checkboxes and between the second and third checkboxes must be 0.36 inches; the space between the third checkbox to the right border of box 13 should be 0.32 inches (see Exhibit A).

Note. More than 50% of an applicable checkbox must be covered by an “X.”

.12 All substitute Forms W-2 (Copy A) and Form W-3 in the red-ink format must have the tax year, form number, and form title printed on the bottom face of each form using type identical to that of the official IRS form. The red-ink substitute Form W-2 (Copy A) and Form W-3 must have the form producer’s EIN entered directly to the left of “Department of the Treasury,” in red.

.13 The words “For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.” must be printed in Flint red OCR dropout ink in the same location as on the official Form W-2 (Copy A). The words “For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.” must be printed at the bottom of the page of Form W-3 in black ink.

.14 The Office of Management and Budget (OMB) Number must be printed on substitute Forms W-3 and W-2 (on each ply) in the same location as on the official IRS forms.

.15 All substitute Forms W-3 must include the instructions that are printed on the same sheet below the official IRS form.

.16 The back of substitute Form W-2 (Copy A) and Form W-3 must be free of all printing.

.17 All copies must be clearly legible. Fading must be minimized to assure legibility.

.18 Chemical transfer paper is permitted for Form W-2 (Copy A) only if the following standards are met.

-

Only chemically backed paper is acceptable for Form W-2 (Copy A). Front and back chemically treated paper cannot be processed properly by scanning equipment.

-

Chemically transferred images must be black.

-

Carbon-coated forms are not permitted.

.19 The Government Printing Office (GPO) symbol and the Catalog Number (Cat. No.) must be deleted from substitute Form W-2 (Copy A) and Form W-3.

.01 Specifications for the SSA-approved substitute black-and-white Forms W-2 (Copy A) and Form W-3 are similar to the red-ink forms (Section 2.1) except for the items that follow (see Exhibits D and E). Exhibits are samples only and may not show the required typeface and/or font. Exhibits must not be downloaded to meet tax obligations.

Note. Even the slightest deviation can result in incorrect scanning and may affect money amounts reported for employees.

-

Forms must be printed on 8.5 x 11-inch single-sheet paper only. There must be two Forms W-2 (Copy A) printed on a page. There must be no horizontal perforations between the two Forms W-2 (Copy A) on each page.

-

All forms and data must be printed in nonreflective black ink only.

-

The data and forms must be programmed to print simultaneously. Forms cannot be produced separately from wage data entries.

-

The forms must not contain corner register marks.

-

The forms must not contain any shaded areas, including those boxes that are entirely shaded on the red-ink forms.

-

The forms must not contain any bolded boxes, including the employee’s social security number (box a) that is on the red-ink forms. The thickness of all lines should be consistent.

-

Identifying numbers on both Form W-2 (Copy A) (“22222”) and Form W-3 (“33333”) must be preprinted in 14-point Arial bold font or a close approximation.

-

The form numbers (“W-2” and “W-3”) must be in 18-point Arial font or a close approximation. The tax year (for example, “2025”) on Forms W-2 (Copy A) and Form W-3 must be in 20-point Arial bold font or a close approximation.

-

No part of the box titles or the data printed on the forms may touch any of the vertical or horizontal lines, nor should any of the data intermingle with the box titles. The data should be centered in the boxes.

-

Do not print any information in the margins of the substitute black-and-white Forms W-2 (Copy A) and Form W-3 (for example, do not print “DO NOT STAPLE” in the top margin of Form W-3).

-

The word “Code” must not appear in box 12 on Form W-2 (Copy A).

-

A 4-digit vendor code preceded by four zeros and a slash (for example, 0000/9876) must appear in 12-point Arial font, or a close approximation, under the tax year in place of the Cat. No. on Form W-2 (Copy A) and in the bottom right corner of the “For Official Use Only” box at the bottom of Form W-3. Do not display the form producer’s EIN to the left of “Department of the Treasury.” The vendor code will be used to identify the form producer.

-

Do not print Catalog Numbers (Cat. No.) on either Form W-2 (Copy A) or Form W-3.

-

Do not print the checkboxes in box 13 of Form W-2 (Copy A). The “X” should be programmed to be printed and centered directly below the applicable box title.

-

Do not print dollar signs. If there are no money amounts being reported, the entire field should be left blank.

-

The space between the two Forms W-2 (Copy A) is 1.33 inches.

.02 You must submit samples of your substitute black-and-white Forms W-2 (Copy A) and Form W-3 to the SSA. Only black-and-white substitute Forms W-2 (Copy A) and Form W-3 for tax year 2025 will be accepted for approval by the SSA. Questions regarding other red-ink forms (that is, red-ink Forms W-2c, W-3c, 1099 series, 1096, etc.) must be directed to the IRS only.

.03 The following guidelines outline the requirements for preparing and submitting both blank and dummy-data substitute black-and-white Forms W-2 (Copy A) and Forms W-3:

-

Send one set of blank and one set of dummy-data substitute black-and-white Forms W-2 (Copy A) and Forms W-3 for approval.

-

Data entries on the dummy-data forms must:

1. Fill the length of each box.

2. Preferably use numeric data or alpha data, depending on the requirements.

-

The “VOID” checkbox must be electronically checked on the dummy-data substitute black-and-white Form W-2 (Copy A).

-

All “Xs” must be centered in box 13 under the applicable checkbox titles on the dummy-data substitute black-and-white Form W-2 (Copy A).

-

All checkboxes on the dummy-data substitute black-and-white Form W-3 must be electronically checked in box b (Kind of Payer, Kind of Employer, and Third-party sick pay).

-

Include the following contact information in your submission:

1. Name

2. Telephone number

3. Fax number

4. Email address

Note. The contact person should be able to answer questions regarding your sample forms.

.04 To receive approval, you may first contact the SSA via email at copy.a.forms@ssa.gov to obtain a template and further instructions. You can either submit your 2025 sample substitute black-and-white Forms W-2 (Copy A) and Forms W-3 in a PDF version electronically for approval to the copy.a.forms@ssa.gov mailbox or send your paper 2025 sample substitute black-and-white Forms W-2 (Copy A) and Forms W-3 to:

Social Security Administration

Direct Operations Center

Attn: Substitute Black-and-White Copy A Forms, Room 341

1150 E. Mountain Drive

Wilkes-Barre, PA 18702-7997

Send your sample forms via private mail carrier or certified mail in order to verify their receipt. You can expect approval (or disapproval) by the SSA within 30 days of receipt of your sample forms.

.05 Vendor codes from the National Association of Computerized Tax Processors (NACTP) are required by those companies producing the W-2 family of forms as part of a product for resale to be used by multiple employers and payroll professionals. Employers developing Form W-2 or W-3 to be used only for their individual company require a vendor code issued by the SSA.

.06 The 4-digit vendor code preceded by four zeros and a slash (0000/9876) must be preprinted on the sample substitute black-and-white Forms W-2 (Copy A) and Forms W-3. Forms not containing a vendor code will be rejected and will not be submitted for testing or approval. If you have a valid vendor code provided to you through the NACTP, you should use that code. If you do not have a valid vendor code, contact the SSA via email at copy.a.forms@ssa.gov to obtain an SSA-issued code. (Additional information on vendor codes may be obtained from the SSA or the NACTP via email at president@nactp.org.)

.07 If you use forms produced by a vendor and have questions concerning approval, do not send the forms to the SSA for approval. Instead, you may contact the software vendor to obtain a copy of the SSA’s dated approval notice supplied to that vendor.

.08 In response to feedback from the user community, the SSA (and the IRS) have added a 2-D barcoded version for the substitute Form W-2 and Form W-3 to the list of acceptable submission formats. This version is an optional alternative to the nonbarcoded substitute Forms W-2 and W-3. Both versions are fully supported by the SSA. At this time, neither the IRS nor the SSA mandates the use of 2-D barcoded substitute forms.

Note. The data contained in the barcode must not differ from the data displayed on the form. If they differ, the data in the barcode will be ignored and the data displayed on the form will be considered the submission. This also occurs when the barcode is not read correctly. The information on the form needs to be manually keyed into the database.

To get the barcode information:

-

See the SSA’s BSO website at www.ssa.gov/bso,

-

Request the PDF version of the specifications by emailing copy.a.forms@ssa.gov, and

-

Download the Substitute Forms W3/W2 2-D Barcoding Standards from www.ssa.gov/employer/subBarCodeStd.pdf.

If you are using a form produced by another vendor that contains a 2-D barcode, you must submit the form for approval using your own NACTP code. Prior to sending your first submission for approval, contact the SSA via email at copy.a.forms@ssa.gov to register your NACTP code and explain what forms you want to submit.

Note. Rules in Section 2.3 apply only to employee copies of Form W-2 (Copies B, C, and 2). Printers are cautioned that the paper filers who send Forms W-2 (Copy A) to the SSA must follow the requirements in Sections 2.1 and/or 2.2 above.

.01 All employers (including those who file electronically) must furnish employees with at least two copies of Form W-2 (three or more for employees required to file a state, city, or local income tax return). The following rules are guidelines for preparing employee copies.

The dimensions of these copies (Copies B, C, and 2), but not Copy A, may differ from the dimensions of the official IRS form to allow space for reporting additional information, including additional entries such as withholding for health insurance, union dues, bonds, or charity in box 14. The limitation of a maximum of four items in box 12 of Form W-2 applies only to Copy A, which is filed with the SSA.

Note. Employee copies (Copies B, C, and 2 of Form W-2) may be furnished electronically if employees give their consent (as described in Regulations section 31.6051-1(j)). See also Publication 15-A, Employer’s Supplemental Tax Guide.

.02 The minimum dimensions for employee copies only (not Copy A) of Form W-2 should be 2.67 inches deep by 4.25 inches wide. The maximum dimensions should be no more than 6.50 inches deep by no more than 8.50 inches wide.

Note. The maximum and minimum size specifications in this document are for tax year 2025 only and may change in future years.

.03 Either horizontal or vertical format is permitted (see Exhibit F).

.04 The paper for all copies must be white and printed in black ink. The substitute Copy B, which employees are instructed to attach to their federal income tax returns, should be at least 9-pound paper (basis 17 x 22-500). Other copies furnished to employees should also be at least 9-pound paper (basis 17 x 22-500) unless a state, city, or local government provides other specifications.

.05 Employee copies of Form W-2 (Copies B, C, and 2), including those that are printed on a single sheet of paper, must be easily separated. The best method of separation is to provide perforations between the individual copies. Whatever method of separation is used, each copy should be easily distinguished.

Note. Perforation does not apply to printouts of copies of Forms W-2 that are furnished electronically to employees (as described in Regulations section 31.6051-1(j)). However, these employees should be cautioned to carefully separate the copies of Form W-2. See Publication 15-A for information on electronically furnishing Forms W-2 to employees.

.06 Interleaved carbon and chemical transfer paper employee copies must be clearly legible. Fading must be minimized to assure legibility.

.07 The electronic tax logo on the IRS official employee copies is not required on any of the substitute form copies. To avoid confusion and questions by employees, employers are encouraged to delete the identifying number (“22222”) from the employee copies of Form W-2.

.08 All substitute employee copies must contain boxes, box numbers, and box titles that match the official IRS Form W-2. Boxes that do not apply can be deleted. However, certain core boxes must be included. The placement, numbering, and size of this information is specified as follows.

-

The core boxes must be printed in the exact order shown on the official IRS form. The items and box numbers that constitute the core data are:

Box 1 — Wages, tips, other compensation

Box 2 — Federal income tax withheld

Box 3 — Social security wages

Box 4 — Social security tax withheld

Box 5 — Medicare wages and tips

Box 6 — Medicare tax withheld

-

The core data boxes (1 through 6) must be placed in the upper right of the form. Substitute vertical-format copies may have the core data across the top of the form. Boxes or other information will definitely not be permitted to the right of the core data.

-

The form title, number, or copy designation (B, C, or 2) may be at the top of the form. Also, a reversed or blocked-out area to accommodate a postal permit number or other postal considerations is allowed in the upper right.

-

Boxes 1 through 6 must each be a minimum of 1 and 1/8 inches wide × 1/4 inch deep.

-

Other required boxes are:

Box a — Employee’s social security number

Box b — Employer identification number (EIN)

Box c — Employer’s name, address, and ZIP code

Box e — Employee’s name

Box f — Employee’s address and ZIP code

Note. Employers may truncate the employee’s SSN on employee copies of Forms W-2. See the 2025 General Instructions for Forms W-2 and W-3 for more information.

Identifying items must be present on the form and be in boxes similar to those on the official IRS form. However, they may be placed in any location other than the top or upper right. You do not need to use the lettering system (a–c, e–f) used on the official IRS form. The employer identification number (EIN) may be included with the employer’s name and address and not in a separate box.

Note. Box d (“Control number”) is not required.

.09 All copies of Form W-2 furnished to employees must clearly show the form number, the form title, and the tax year prominently displayed together in one area of the form. The title of Form W-2 is “Wage and Tax Statement.” It is recommended (but not required) that this be located on the bottom left of substitute Forms W-2. The reference to the “Department of the Treasury — Internal Revenue Service” must be on all copies of substitute Forms W-2 furnished to employees. It is recommended (but not required) that this be located on the bottom right of Form W-2.

.10 If the substitute employee copies are labeled, the forms must contain the applicable description.

-

“Copy B, To Be Filed With Employee’s FEDERAL Tax Return.”

-

“Copy C, For EMPLOYEE’S RECORDS.”

-

“Copy 2, To Be Filed With Employee’s State, City, or Local Income Tax Return.”

It is recommended (but not required) that these be located on the lower left of Form W-2. If the substitute employee copies are not labeled as to the disposition of the copies, then written notification using similar wording must be provided to each employee.

.11 The tax year (for example, “2025”) must be clearly printed on all copies of substitute Form W-2. It is recommended (but not required) that this information be in the middle at the bottom of the Form W-2. The use of 24-point OCR-A font is recommended (but not required).

.12 Boxes 1 and 2 (if applicable) on Copy B must be outlined in bold 2-point rule or highlighted in some manner to distinguish them. If “Allocated tips” are being reported, it is recommended (but not required) that box 8 also be outlined. If reported, “Social security tips” (box 7) must be shown separately from “Social security wages” (box 3).

Note. Box 8 may be omitted if not applicable.

.13 If employers are required to withhold and report state or local income tax, the applicable boxes are also considered core information and must be placed at the bottom of the form. State information is included in:

-

Box 15 (State, Employer’s state ID number),

-

Box 16 (State wages, tips, etc.), and

-

Box 17 (State income tax).

Local information is included in:

-

Box 18 (Local wages, tips, etc.),

-

Box 19 (Local income tax), and

-

Box 20 (Locality name).

.14 Boxes 7 through 14 may be omitted from substitute employee copies unless the employer must report any of that information to the employee. For example, if an employee did not have “Social security tips” (box 7), the form could be printed without that box. But, if an employer provided dependent care benefits, the amount must be reported separately, shown in box 10, and labeled “Dependent care benefits.”

.15 Employers may enter more than four codes in box 12 of substitute Copies B, C, and 2 (and 1 and D) of Form W-2, but each entry must use codes A–II (see the 2025 General Instructions for Forms W-2 and W-3).

.16 If an employer has employees in any of the three categories in box 13, all checkbox headings must be shown and the proper checkmark made, when applicable.

.17 Employers may use box 14 for any other information that they wish to give to their employees. Each item must be labeled. (See the instructions for box 14 in the 2025 General Instructions for Forms W-2 and W-3.)

.18 The front of Copy C of a substitute Form W-2 must contain the note “This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.”

.19 Instructions similar to those contained on the back of Copies B, C, and 2 of the official IRS Form W-2 must be provided to each employee. An employer may modify or delete instructions that do not apply to its employees. (For example, remove Railroad Retirement Tier 1 and Tier 2 compensation information for nonrailroad employees or information about dependent care benefits that the employer does not provide.)